Retirement options explained

In this video we take a look at your options for taking your money when it comes to retire. From how you do it to the rules and regulations you need to be aware of, Retirement Options Explained has got you covered.

Picture the scene. You're kicking back on a sun lounger, chilled drink in hand, no emails mounting up, no boss to answer to. Yes, retirement is within reach!

But before you start the longest holiday of your life, you've got one last job left to do - understanding the different ways you can take your pension pot.

00:21

Admittedly, knowing what is right for you is a lot easier said than done, but the good news is, we're here to help. We've summarised the main choices to get you started.

00:36

First things first, (and probably most importantly), whichever way you choose to take your money, you're usually able to take up toof your pension pot tax-free. The rest of your money is taxed as income when you take it.

As soon as you reach age 55 (age 57 from 2028), you can take your money from your defined contribution pension...

01:00

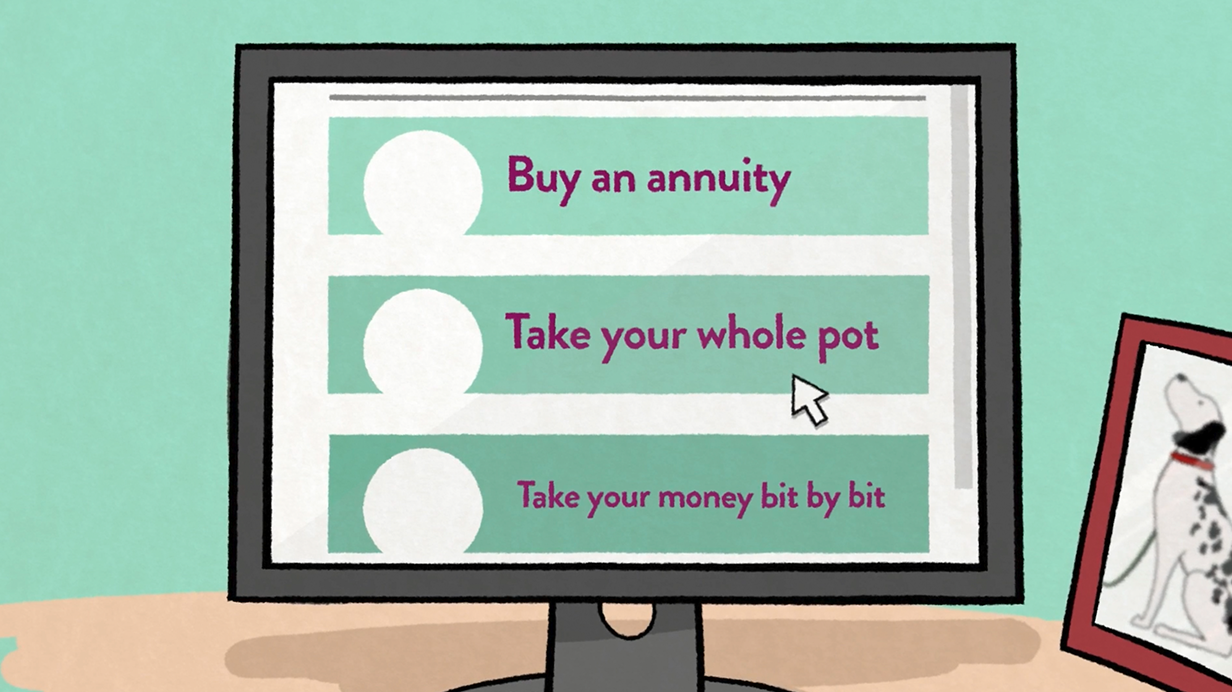

...and there are 3 main ways to do this:

One way of taking money from your pension is to buy an annuity from an insurance company. This gives you a guaranteed income in retirement for life or an agreed number of years.

There are 5 different types of annuities - from fixed to enhanced...

...and you can shop around to find the best annuity deal.

01:21

Another way is to take your whole pot in one go.

Now this may sound tempting but taking large sums of money at once, depending on your circumstances, could land you a hefty tax bill...

...and you'll need to budget your money carefully or you could run out.

01:40

The third way is taking your money bit by bit, little by little.

If you decide to take this route, there are two ways to access your pot. One way is to take your tax-free cash first.

You can do this all at once and the rest of your pot stays invested, meaning it has the potential to grow - though, like most things in life, this isn't guaranteed.

Taking your money this way is called flexi-access drawdown.

Alternatively, you can receive your money in installments, each time benefitting from a tax-free 25%. Your remaining money stays invested and is taxed as income when you take it.

We call this kind of withdrawal, wait for it…an uncrystallised funds pension lump sum.

02:25

If a mix of these different options suits you better, you can choose to do this instead. And you can watch it all from. And, if you don't need your money yet, you can leave your pot where it is, giving it the potential to grow.

02:35

If you're over 50 and haven't already, speak to Pension Wise a service from MoneyHelper, backed by the Government.

Their friendly experts will guide you through the different choices - and it's free and impartial. You may also need more in-depth financial advice. If you do, MoneyHelper can help you to find a financial adviser, just visit their website.